Life Insurance License Prep iOS and Android App

Master Your Life Insurance Licensing Exam with Life Insurance License Prep!

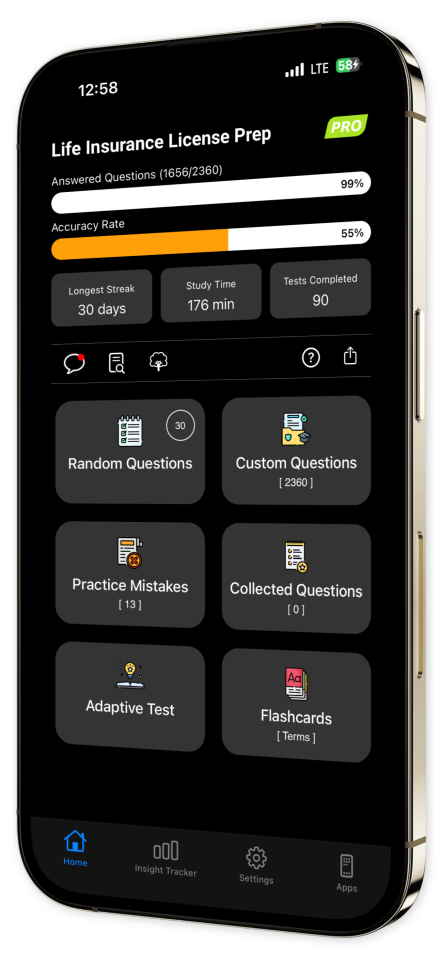

Prepare to excel in your life insurance licensing exam with Life Insurance License Prep — the ultimate app dedicated exclusively to helping you become a successful life insurance agent. Whether you're new to the industry or an experienced professional aiming to expand your credentials, our app is specifically designed to help you master the essential knowledge and skills needed to pass your life insurance licensing exam with confidence.

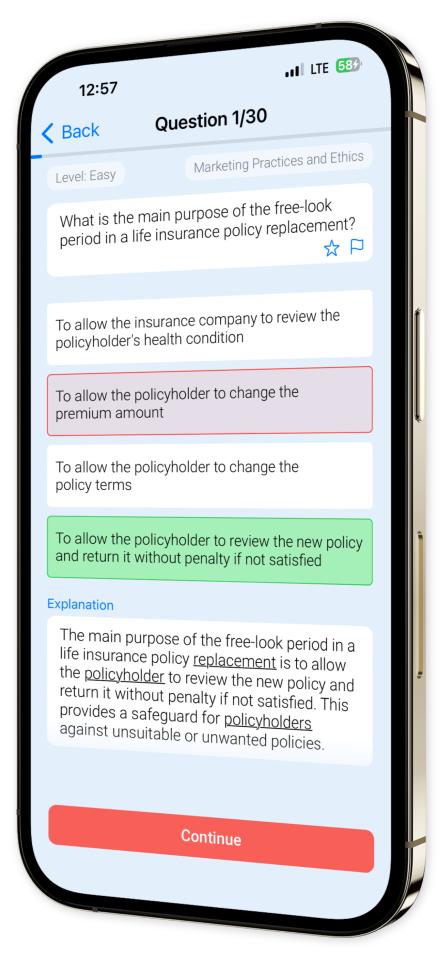

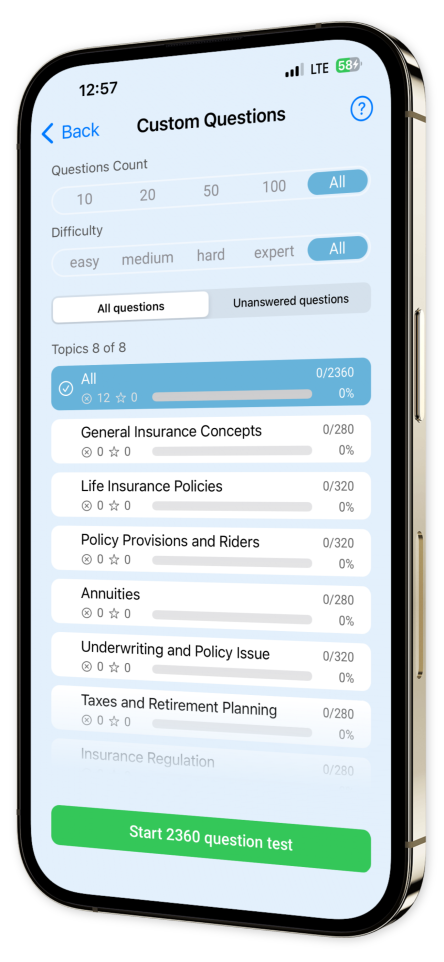

Dive deep into a comprehensive collection of exam-focused questions covering key topics like life insurance policies, annuities, policy provisions, riders, underwriting processes, state regulations, and ethical practices specific to life insurance. Each question comes with detailed explanations to ensure you fully understand the concepts and can apply them effectively in real-world scenarios.

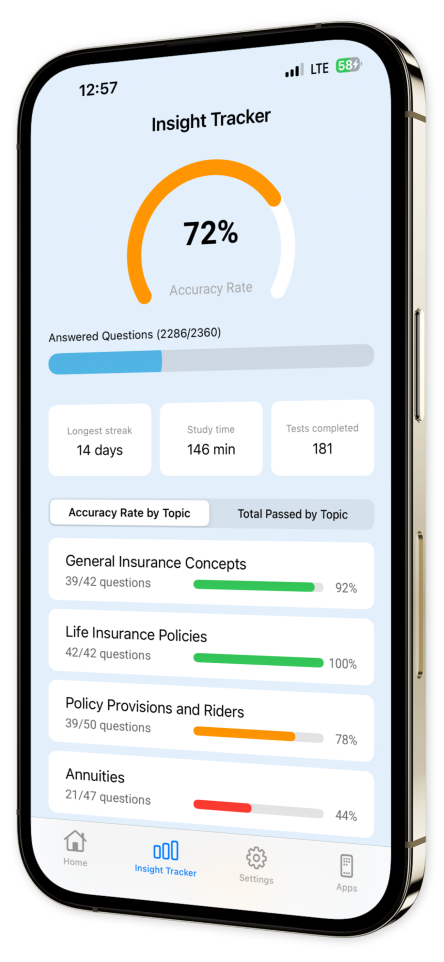

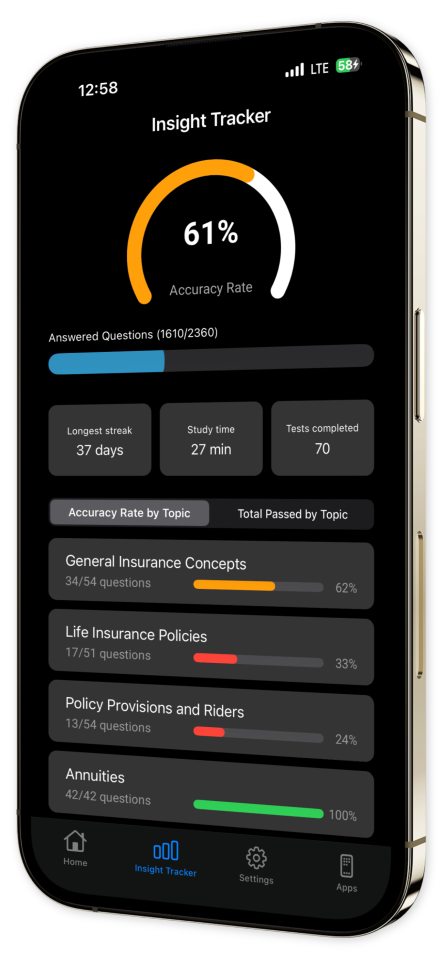

With advanced analytics and personalized feedback, you can track your progress, identify areas for improvement, and focus your study efforts where they are needed most. Our app adapts to your learning style, providing a customized study plan that fits your schedule and maximizes your exam readiness.

Join thousands of aspiring life insurance professionals who have successfully passed their exams and advanced their careers with Life Insurance License Prep. Take control of your future, expand your opportunities, and become a trusted advisor in the life insurance industry.

Download now and take the first step toward becoming a licensed life insurance professional today!

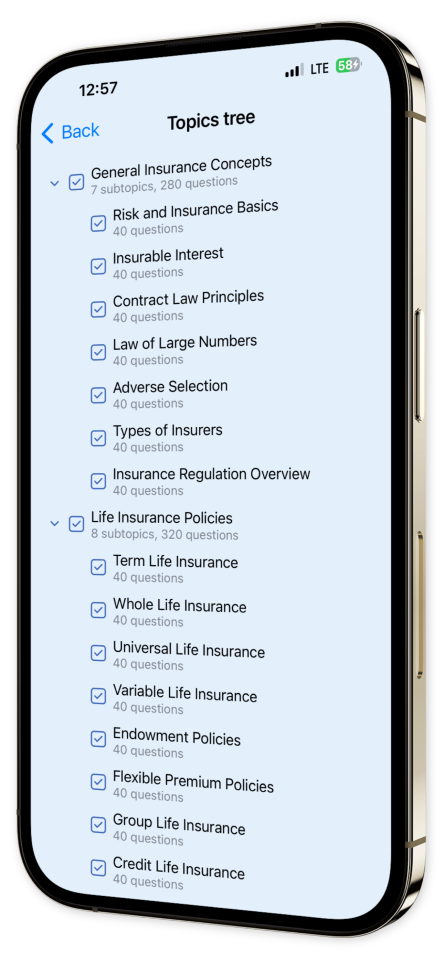

Content Overview

Explore a variety of topics covered in the app.

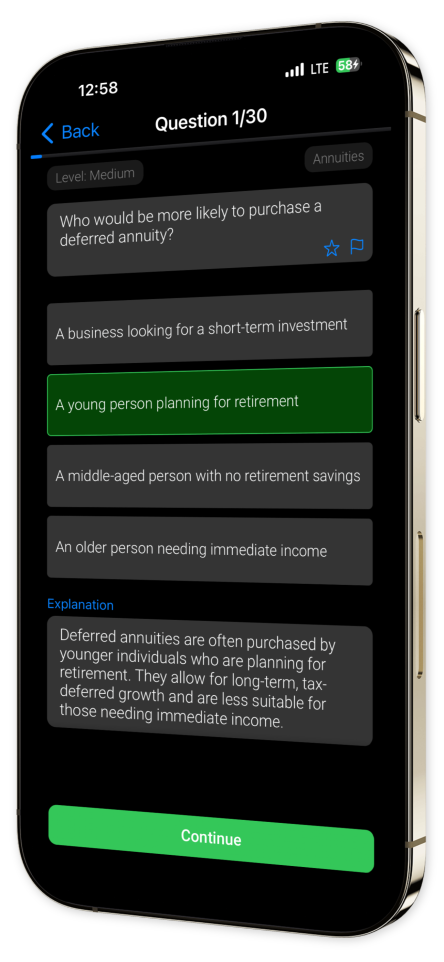

Example questions

Let's look at some sample questions

Can you have more than one Credit Life Insurance policy?

Yes, but only with different lendersNo, you can only have one policyYes, but only for different loansNo, it is illegal to have more than one policy

You can have more than one credit life insurance policy if you have more than one loan that you want to cover.

What is the term for a beneficiary who is second in line to receive the death benefit?

Secondary beneficiaryContingent beneficiaryRevocable beneficiaryIrrevocable beneficiary

A contingent beneficiary is second in line to receive the death benefit, after the primary beneficiary.

What is a disadvantage of immediate annuities?

They do not provide immediate incomeThey have high fees and expensesThey do not allow for long-term growthThey require a large upfront investment

A disadvantage of immediate annuities is that they do not allow for long-term growth. Once the annuity is purchased and the payments begin, there is no further accumulation of value.

What is the main feature that distinguishes indexed annuities from other types of annuities?

Indexed annuities have a fixed interest rateIndexed annuities have no risk of loss to the principalIndexed annuities are linked to a market indexIndexed annuities offer a guaranteed minimum income benefit

The distinguishing feature of indexed annuities is that they are linked to a market index. This means that the interest earned on the annuity is based on the performance of the index.

Which of the following is not a typical use of immediate annuities?

Funding retirement incomePaying out lottery winningsProviding a death benefitSettlement of a personal injury lawsuit

Immediate annuities are typically used for funding retirement income, paying out lottery winnings, or settling a personal injury lawsuit, but not for providing a death benefit.

Who is responsible for ensuring that all questions on the life insurance application are answered accurately?

The insurance agentThe underwriterThe applicantThe insurer

The applicant is responsible for ensuring that all questions on the life insurance application are answered accurately. While the insurance agent may assist in filling out the application, it is ultimately the applicant's responsibility to provide accurate information.

Who bears the risk during the period covered by a conditional receipt?

The applicantThe insurerThe beneficiaryThe insurance agent

The insurer bears the risk during the period covered by a conditional receipt, not the applicant, beneficiary or insurance agent.

What is the purpose of the Social Security trust funds?

To pay current benefitsTo invest in the stock marketTo loan money to the federal governmentAll of the above

The primary purpose of the Social Security trust funds is to pay current benefits. The funds are not used for investment in the stock market or to loan money to the federal government.

What does the Do Not Call Registry prevent?

Telemarketing callsEmail spamDirect mail advertisingInternet pop-up ads

The Do Not Call Registry prevents telemarketing calls to the numbers listed on the registry.

What is the main purpose of the Patient Protection and Affordable Care Act (PPACA)?

To regulate the interest rates charged by health insurance companiesTo ensure that individuals do not lose their health insurance when they change jobsTo expand access to health insurance, protect patients against arbitrary actions by insurance companies, and reduce costsTo prevent health insurance companies from sharing personal health information

The main purpose of the PPACA is to expand access to health insurance, protect patients against arbitrary actions by insurance companies, and reduce costs. It includes a variety of provisions that are intended to increase the affordability and quality of health insurance.